First Out- of-State Deal

Two years after my first deal, I was ready to buy my second deal. I’m writing this post in August 2023, and it is a VERY different market from 2020. Kim and I weren’t married yet, but we were both on the real estate train. I was still stationed at JBLM, Kim was working in San Francisco, and Marcus was stationed in Texas. Prices in Washington were exponentially increasing, and finding the money for a 20-25% down payment was tough. Using my VA loan again would be tough since I was still living in Tacoma, and I hadn’t undergone a “significant life event” that would warrant me moving out of the fourplex.

We started looking at other markets and Kim’s best friend, Kate, had just moved to Memphis, TN. Kate and her husband, Kenny, were getting into real estate and just bought a duplex in the city. In our mind, the stars all aligned and were pointing at Memphis. Prices were cheap (houses for $100k), Kenny was working as a property manager, and they had a great agent and lender already in place.

Now, remember when I said it was a very different time? When we approached Kate and Kenny’s agent, she had a list of about 20 properties that investors were looking to sell… These were true pocket listings. As new investors, we were able to underwrite each property, talk with Kenny about the area, and submit offers without having to worry about bidding wars.

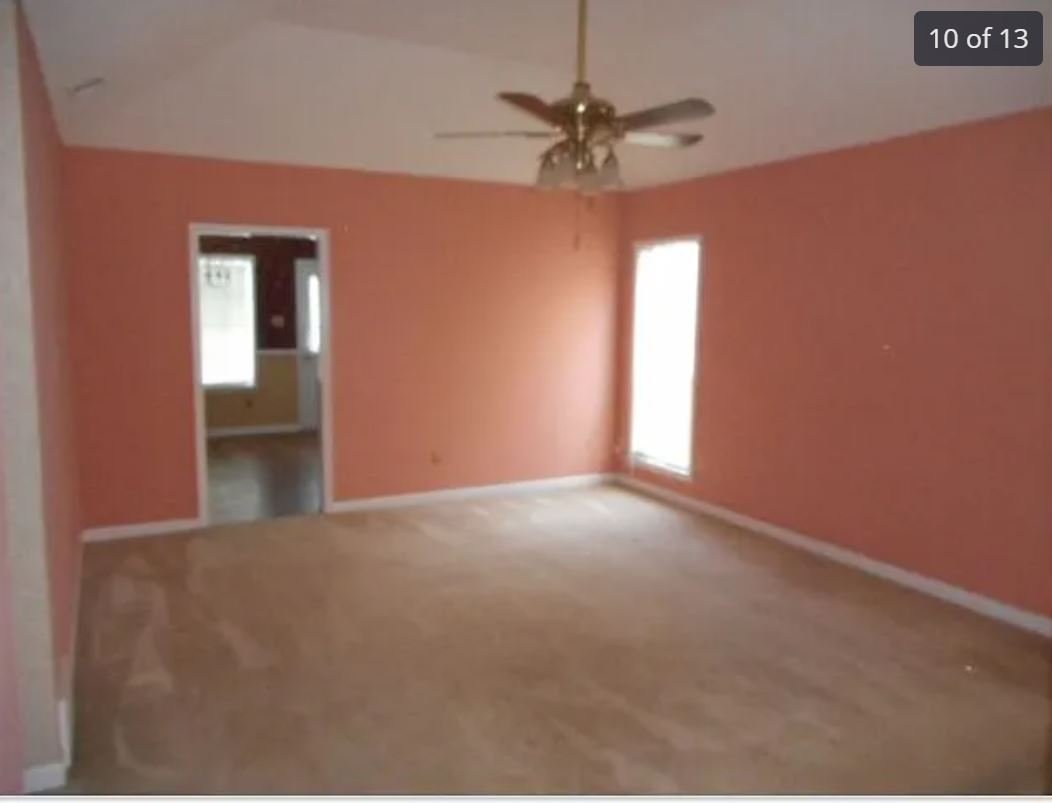

This is how we bought our second property. It was an occupied attached house for $82,000 at 4% interest and 20% down with an in-place tenant paying $850/month, which covered the $530 mortgage payment.

Underwriting

This was my first property underwriting on my own and I was nervous. I used the BiggerPockets Rental calculator and rental information from Kenny, who acted as our property manager, and Rentometer.

Business Plan

At $850/month, the in-place tenant’s rent was ~$300 under market at the time of purchase, but the home also needed to be updated to get market rent. We weren’t really in the place to do a rehab, and our agent and property manager kept harping on how good of a tenant we had. We decided we would keep rent as-is, and renovate the property if she moved. While we wouldn’t be maximizing profits, it was a sound business plan for where we were in our real estate journey. A few notes on this strategy:

Kenny had a great contractor, and I think we could have renovated the property pretty smoothly. The biggest issue was financing the rehab and how that would affect us buying our next property.

We did make some small improvements, including replacing some appliances and fixing up the kitchen.

Knowing what I know today, I am not sure what business plan I would decide on, and that should show you how valuable a great tenant is! I have the money to renovate the property, but any renovation comes with a certain level of headaches. I also know our current tenant can’t afford market rent, but the property is in a decent neighborhood and amazing school district, so finding another good tenant would be possible.

Outcome

I’m going to try out Occupied Units instead of Stars and see if it sticks.

This deal was a low-speed underhand softball toss, and we took it for granted. It had everything you want in a deal: a great in-place team, a great location, and a great in-place tenant. On our next property, you will see how we took those things for granted. Nonetheless, this deal gets another 5/5 Occupied Units (i.e. 100% occupancy).

Here’s what I’d change knowing what I know now:

This isn’t specific to this property, but I’d make sure I’m reminding the tenant of recurring maintenance (i.e. changing AC filters, cleaning lint traps, etc.).

Based solely on this tenant, I might give her a stipend to make the improvements she wants. This is only for this tenant because she treats the property like her own home.